GlobalData’s latest report, ‘Italy Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations and Competitive Landscape’, discusses the power market structure of Italy and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

The recent Ukraine crisis has hugely dented the gas supply security of Italy. Nearly 40% of Italy’s gas imports are from Russia. While it will help prevent a power crisis, turning to Qatar is a very short-term solution, and the government will need to act fast to build renewable generation and modernise its grids to meet rising demand. Imports account for more than 90% of Italy’s gas needs in 2021, sourcing largely from Southern Europe and Russia by pipeline across Ukraine.

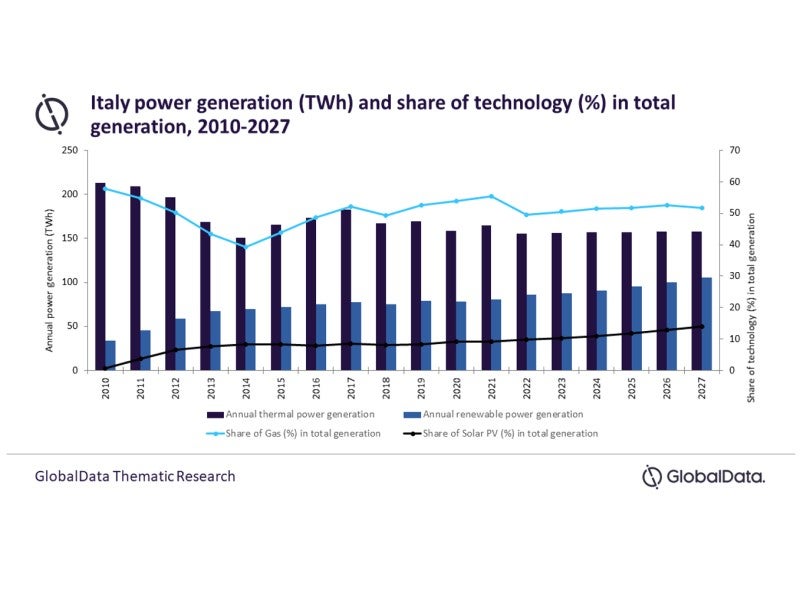

While Italy currently generates 47.4% of its energy from thermal power (coal, gas and oil), it does not possess substantial domestic fossil fuel reserves, and heavily depends on imports. In fact, Italy imports the second-largest amount of gas in Europe, after Germany. Avoiding dependence on other countries is high on Italy’s list of ‘to-do’s’, with the focus being on replacing thermal with solar.

Italy’s attempts to shed its gas will be a struggle, post an initial push in 2022. The country is expected to reduce its gas-based thermal generation percentage from 55.5% in 2021 to 49.5% in 2022, but then it sticks around the 51.7% mark up to 2027.

The government has started to replace thermal power plants with renewable sources to meet rising energy demand and concerns over energy security but there is some work to do yet. However, wind and solar photovoltaic (PV) have made tremendous progress in the country, and these are set to play a major role in meeting the country’s power demand in the longer term. Conventional plants will still be present to take the baseload and manage fluctuations in supply.

Focusing more on energy storage systems would be a good start, as well as modernising current grids and building biopower and offshore wind – most of the work so far has been on-shore. However, it is noteworthy that, in the wake of the Ukraine crisis, State-controlled Terna revealed plans to spend €10bn ($11bn) over the next four years to upgrade the country’s power grid to meet energy security and climate change demands.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataItaly is one of the leading European economies and, along with Germany, France and the UK, has spearheaded economic growth in Europe. The key drivers of Italy’s GDP growth have been exports of apparels, metals and metal products, luxury vehicles and motorcycles, food, agricultural products, and transportation equipment.

GDP declined from $2,125.1bn in 2010 to $2,072.6bn in 2021 at a negative CAGR of -0.2 % (constant rates). Italy’s economy took a major hit during the pandemic, with GDP declining by 8.9% in 2020 from 2019. Backed by several funding programmes from the government and support from the EU, the economy stabilised with the GDP growing by 3.4% in 2021 from 2020, with all the above rates being at constant rates. GDP is expected to reach pre-pandemic levels between 2022 and 2023.

Related Company Profiles

Terna SpA